Brighton and Hove City Council has £15 million on loan to other councils nationwide.

The figure is revealed in a freedom of information (FoI) request to the council.

In addition, until the end of last month, the council also had a £9 million loan to Broxbourne Borough Council. This was paid back at the end of August.

The FoI request followed Thurrock Council’s repayment of loans totalling £15 million from Brighton and Hove – most of it borrowed when the Essex authority’s finances were under scrutiny.

Thurrock Council was effectively made bankrupt after investing £655 million in a solar farm business run by businessman Liam Kavanagh.

The Bureau of Investigative Journalism revealed that he spent £130 million of taxpayer money on a country estate, private jet, luxury yacht and other multimillion-pound purchases, including a Bugatti supercar.

By February this year, the Conservative-run Essex council was £1.5 billion in debt and talks with the government to borrow up to £636 million to help balance its books.

Three outstanding loans as well as the Broxbourne loan are listed in response to the FoI request.

- Broxbourne Borough Council borrowed £9 million for one year from 31 August 2022 at an interest rate of 1.6 per cent

- Blackpool Borough Council borrowed £5 million for one year from 13 March 2023 at an interest rate of 4.6 per cent

- Powys County Council borrowed £5 million for five years from 20 December 2019 at an interest rate of 2.05 per cent

- Cambridgeshire County Council borrowed £5 million over three years from 8 February 2021 at an interest rate of 1 per cent

The response to the request said that all the loans to other councils were for “treasury management purposes” to manage cash flow.

It said:

“As a result, there has been and can be no impact on council services in order to undertake these loans.

“Each loan was undertaken by the treasury management team on behalf of the chief finance officer, who has delegated powers from full council to undertake investment activities within the parameters and limits set and approved by the full council.”

Labour councillor Jacob Taylor, the lead councillor for finance, said:

“Councils routinely lend money to other councils because it’s an excellent way of managing cash flow and maximising resources.

“There are often differences in timing between us receiving income and being able to spend it. This results in the council regularly having positive cash balances.

“The government recognises that using cash balances in this way is an entirely appropriate and legitimate way to optimise council finances.

“Lending some of it to other councils is not only very secure, it also enables us to charge interest and thus generate income until the cash is needed for its intended purpose.

“Cashflow surpluses arise from all income to the council – not just council tax which is a relatively small proportion of our overall income.”

Officers Release New Images Following Chichester Assault

Officers Release New Images Following Chichester Assault

Sussex Apprentices Share Experiences During National Apprenticeship Week

Sussex Apprentices Share Experiences During National Apprenticeship Week

Appeal After Repeated Criminal Damage At Crawley Address

Appeal After Repeated Criminal Damage At Crawley Address

Former Hove Scout Leader Jailed For Dozens Of Child Sex Offences

Former Hove Scout Leader Jailed For Dozens Of Child Sex Offences

Men Found Not Guilty Of Rape In Eastbourne

Men Found Not Guilty Of Rape In Eastbourne

Crawley Residents To Face April Council Tax Rise

Crawley Residents To Face April Council Tax Rise

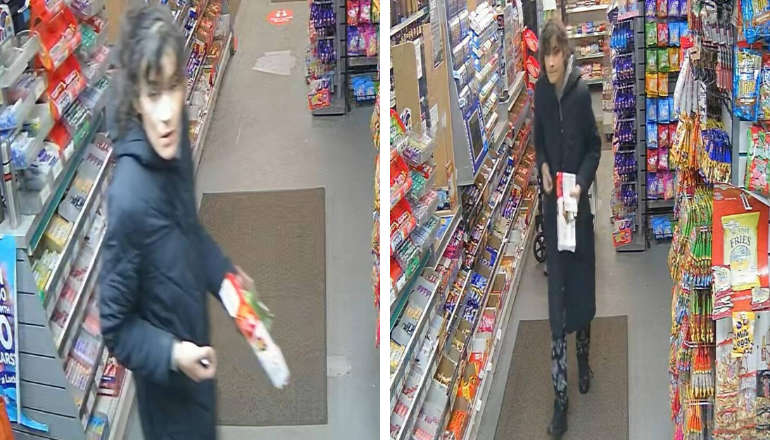

Appeal Over High-Value Distraction Theft In Brighton

Appeal Over High-Value Distraction Theft In Brighton

Appeal In Connection With Burglary Near Eastbourne

Appeal In Connection With Burglary Near Eastbourne

Crawley Tenants Set To Be Hit By Rent Increase

Crawley Tenants Set To Be Hit By Rent Increase

Stone Balustrade To Return To Seafront Building

Stone Balustrade To Return To Seafront Building